Is the current economic environment favourable to external growth?

It is true that the current period has been volatile, initially featuring a strong and particularly active post-Covid recovery, then a backdrop of shortages and inflation.

However, at Initiative & Finance we firmly belief that a company must be able to grow by acquisition as part of its development strategy, regardless of the general economic environment. We invest in strong and ambitious companies with the ability to pursue their development strategy even when the economic environment is more challenging. Leaner periods are also attractive in that valuations are more attractive and competition is less intense.

What are the benefits of a build-up strategy?

A build-up strategy is a great growth accelerator. It often shortens the time needed to:

- Strengthen a regional network;

- Expand the portfolio of products or services on offer;

- Integrate the value chain;

- Develop internationally.

What support do you provide to management in such transactions?

Such deals often form part of the growth plans we produce with the management of our holdings, at the time we first invest. Not all make this choice, because some have enough on their plates with their plans for organic growth, but we always offer our support.

We support them from the outset: when targets are identified, then in making direct approaches, and in negotiating and structuring transactions. In terms of identifying opportunities, we can also use our dense network of intermediaries, both in France and internationally. We have preferred partners abroad who can assist in all parts of the world.

When making an approach to a target company, our position as an active shareholder seeking to promote the development of our stake is an asset: we are not in the position of the company itself approaching a particular competitor, say, nor of a third party. Our support continues throughout the acquisition process, during preparation of the takeover bid, until the deal is closed.

Do you notice any common challenges for companies undertaking this kind of building up?

Special attention must always be paid to the human factor, which is essential to successfully integrating targets.

A company that intends to carry out external growth must also be sure it has very solid foundations and good visibility over its business indicators, costs and margins. Under these conditions, it can keep control over its strategy. It is also on these points that we offer our support to our partners-directors, to help them structure when necessary.

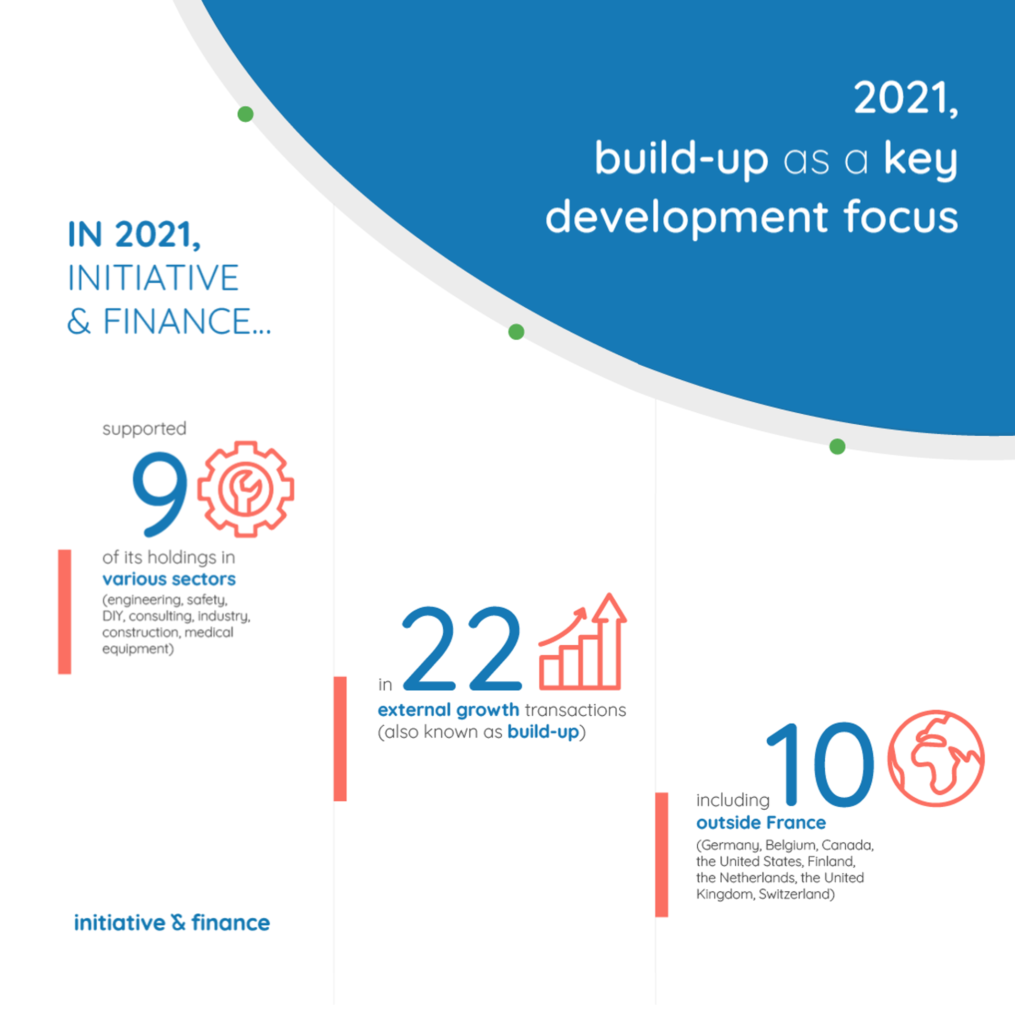

Since 2015, more than 70 external growth transactions have been completed, i.e. on average 2 acquisitions for each of our partner companies.

Back to the thematic folder

Back to the thematic folder