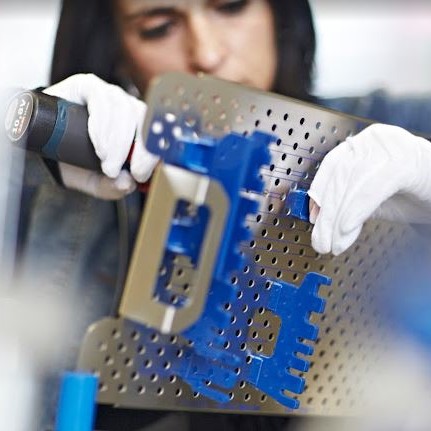

Operating in the niche market of transport trays and the washing and sterilisation of surgical instruments, Inomed has established a strong reputation in Western Europe. The company, based in the canton of Bern in Switzerland, is a preferred supplier to major manufacturers of orthopaedic prostheses medical equipment.

Demographic growth, an ageing population, an increase in average body size and the desire for medical comfort are all challenges for companies in the healthcare sector. To meet this increased demand, Inomed chose to look beyond the Swiss borders to maximise its presence in the European Union with the acquisition of NTOC Medische Techniek BV, based in Oss, the Netherlands. This strategic choice is explained above all by the complementary nature of the two companies: “NTOC offers products that are similar, but not identical, to a target market concentrated around the five largest customers worldwide, known as “Majors”, without any overlap with Inomed’s historic customer base, which is made up of “Challenger” companies, explains Pierre-Louis Beaud. It provides us with a way of consolidating our position in Europe”.

The first stages of the acquisition took place smoothly, facilitated by Initiative & Finance, which contributed to the initial contact phase and then led the due diligence exercise and the signing of agreements.

Solving the cultural difference equation

However, while Switzerland and the Netherlands appear to be culturally similar, the subsequent phases of the acquisition did not go altogether smoothly. For Pierre-Louis Beaud, it was at the time integration took place that stumbling blocks arose. “Cultural difference is a real issue, particularly in terms of employment laws”, he says.

Certain issues, in particular the way in which responsibility was to be shared with NTOC’s management team, also proved to be difficult to solve. “It is crucial to clearly define each person’s responsibilities before starting on the integration”, stresses the Chairman of Inomed.

A complex equation needs to be solved, and that requires time and effort. “You need to overcome resistance to change! I believe that this can be achieved through hard work and exemplarity.” A belief that requires regular visits to the Netherlands branch. Supported by an on-site transition manager, Inomed’s chairman spends approximately three days each week in NTOC’s head office in order to understand local working methods and help ensure that its subsidiary is profitable.

In terms of compliance, both entities are subject to the European regulations on medical devices (MD), which changes regularly. The most recent change: the entry into force in May 2021 of new Regulation 2017/745 (EU Medical Device Regulation), the scope of which has been extended and which governs the key stages in the marketing of medical devices. Clinical evaluation, marketing, traceability, etc. The regulation covers the entire value chain.

While the rules are the same for Inomed and NTOC, in some cases, the texts are, however, interpreted differently. According to Pierre-Louis Beaud, regardless of these different interpretations, which also result from cultural biases, interactions with the market must be guided by the highest standards, and above all the interests of customers.

In addition to paying attention to financial aspects, the extent of socio-cultural differences also needs to be assessed. Pierre-Louis Beaud is motivated by the desire to continue growing the company and increasing its customer base and does not rule out acquiring other businesses in the coming years.

[1] Source : European Medicines Agency – url : https://www.ema.europa.eu/en/human-regulatory/overview/medical-devices

Back to the thematic folder

Back to the thematic folder